Buying a house can be an exciting process but it can be challenging as well. There are various things that one needs to consider before purchasing a home in Florida. The more you will learn about these things, it will become easier for you to further narrow down your choices. Check out the points below to know about the things that can make a lot of difference while you are buying a house in Florida.

1. Search for the right property:

This is the place where your realtor’s knowledge and experience become an integral factor. Address them about the things you’re searching for in your new home. The more subtleties you can give them the better so they can limit your choices around the city.

One of the principal choices you want to make is whether you intend to construct your own home or buy one that has effectively been built.

Talk about key highlights you would like the property to have including the quantity of rooms and restrooms, whether you need a pool, the size of the yard, a solitary story or two stories, and others. You might ask your property dealer what they feel is the best spot to purchase a house in Florida. It would be great if you check out hidden dunes condos for sale to get the best deals in the state of Florida.

From that point, you’ll find the opportunity to glance through different homes and see what the regions bring to the table. If you have children, you’ll need to think about the nearby educational systems. What’s more, assuming you as of now hold a job in the same location, you should see the distance that you need to travel daily.

2. Find a real estate agent:

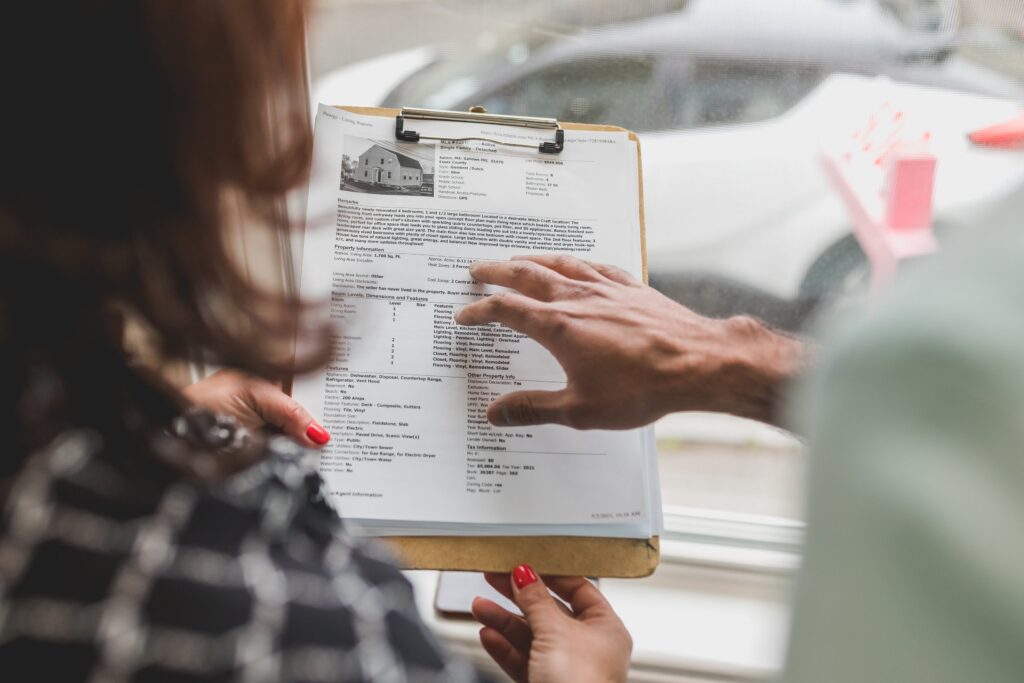

Your realtor will be your primary partner during the home purchasing process. Beside finding and showing you houses, they can likewise make suggestions for different administrations like legal counselors, moneylenders, and escrow organizations. Also, when you observe a house, he will ensure you get an incredible deal.

When you have a rundown of 3-5 real estate agents, make a time table to meet with them to check whether they’d be a solid match. Ask them inquiries related to the neighborhood you’re checking out (schools, patterns in property estimations, any arranged developments) to check whether they have the information and experience to assist you with settling on a good choice.

3. Market conditions of Florida:

In recent years, the real estate market has been on the ascent, however economic situations vary on a predictable premise. As the truism goes, the main consistency is change, and this is particularly obvious with land all around the United States. Purchasing a house at the right cost is vital to remain above water regardless of how the monetary conditions will look like in future. Therefore it is essential to analyze the market conditions of the state before purchasing a property in Florida.

4. Inspections:

Regardless of where you decide to purchase a home, getting a home inspection is critical. By allowing an expert to assess it all around, you can guarantee there are no issues that make it dangerous for your living. Close by this, buying a defected house implies you might experience difficulty selling it for benefit from now on. The right inspection administration should cover everything from erosion problems to structural harm.

5. Homeowner’s insurance:

Florida is a pretty place with miles of seaside heaven yet don’t allow the image of perfect climatic conditions stunt you into thinking that this state is excluded from unpleasant and intense climate. Floods and typhoons are normal in this state and the most effective ways to get ready for these kinds of fiascos are to purchase a home that is worked to endure high power breezes, and put resources into the right property holder’s insurance.

While considering the amount you can bear the cost of each month for your home loan, remember to appraise extra expenses for insurance into your last spending plan. It’s never an ill-conceived notion to call an insurance agency and get some information about homes you are keen on. Any insurance specialist ought to be content to furnish you with a concise expense correlation in the event that you are stuck between two distinct properties.

6. Make an offer:

Once you have made up your mind about which house you like, it is time to make offers and try to convince the seller. Talk about the property you want to purchase with your real estate dealer and tell them how much you are willing to spend on it. This will assist them in making an offer on your behalf and send it to the seller.

Other than the offer, the contract can contain other details as well such as the repairs that are required to be done, appliances that you would require, and the timeframe in which you will close the deal.

The seller has three options. He can either reject or accept the offer or he can also choose to counter-offer. Your real estate agent will manage the whole process for you. He will make sure to negotiate as much as he can and provide you the best arrangement.

7. New renovations:

Something else to consider prior to purchasing a home in this state is assuming you intend to roll out any improvements to a new house. A few houses will cost more than others to get repaired, and you will not get stuck with a property that you are not content with. Close to this, assuming you really do observe a home that you like, you want to ponder whether you can bear to roll out the renovation costs before moving in.

To Sum Up

Purchasing a home in Florida can be a tough task to do. That is why it is very important to do your research. We have given a list of different things that you should keep in mind while looking for your perfect dream house in Florida.